By Lambert Strether

Quietly, subtly, almost imperceptibly, the rules governing global trade and financial markets are changing. It is not happening by accident, but by wilful design. Despite the enormous impact it will have on all our lives, the public is not being consulted on any aspects of the process. Most people are not even aware it is happening.

The main driver of this change are the bilateral and multilateral trade and investment treaties being negotiated in complete secrecy and behind closed doors between corporate lobbyists, free trade activists and our own elected “representatives” (a term I use in the loosest possible sense, especially given the context). The ultimate goal of these treaties is to reconfigure the legal apparatus and superstructures that govern national, regional and global trade and business – for the primary, if not exclusive, benefit of the world’s largest multinational corporations.

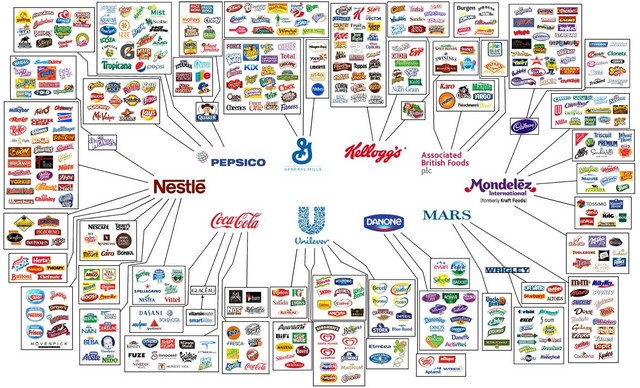

Corporations have long been powerful economic and political entities, but in recent decades some have grown to dwarf even middling-sized national economies. According to a ranking published by Global Trends, 58 percent of the world’s biggest 150 economic entities in 2012 were corporations. They include oil, natural gas, and mining majors, banks and insurance firms, telecommunications giants, supermarket behemoths, car manufacturers, and pharmaceutical companies.

Changing the Law

Right now, the representatives of many of these firms are engaged in late-stage negotiations with the U.S. and European political leaders that would make it financially calamitous for a nation-state to take any actions against the interest of corporations. If passed — and at this rate, it almost certainly will be — it will be the biggest bilateral trade deal in the history of mankind.

What’s up for grabs in the innocuously named “Transatlantic Trade and Investment Partnership” (TTIP) is nothing short of the control and ownership of virtually every economic sector and public service in both Europe and the U.S. – with the exception, at the insistence of the U.S. government, of the financial services industry. Unbeknownst to almost all Europeans, the European Commission has shown a keen interest in opening up all public services to foreign corporate ownership, from health care to education, pensions to water provision.

Wikileaks also revealed that a group of 50 nations, fronting themselves as “Really Good Friends of Services” (who said lobbyists don’t have a sense of humour?), is secretly negotiating the Trade in Services Agreement (TISA). The countries taking part in negotiations include the U.S., the member nations of the EU (who are naturally leading the proceedings), and U.S.-aligned nations of Australia, Canada, Chile, Costa Rica, Hong Kong, Iceland, Israel, Japan, Liechtenstein, Mexico, New Zealand, Norway, Panama, Peru, South Korea, and Switzerland. Conspicuously absent from the list are the five BRICS nations Brazil, Russia, India, China, and South Africa and Latin American members of Mercosur.

Based on the draft copy recently released by Wikileaks, the treaty seeks to (among many other things):

“Lock in” the privatisations of services – even in cases where private service delivery has failed – meaning governments can never return water, energy, health, education or other services to public hands.

Restrict a government’s right to regulate stronger standards in the public’s interest. For example, it will affect environmental regulations, licensing of health facilities and laboratories, waste disposal centres, power plants, school and university accreditation and broadcast licenses.

Specifically limit the ability of governments to regulate the financial services industry at exactly the time when the global economy is still recovering from a crisis caused by financial deregulation.

The trade treaties are not just about rewriting laws; they are also about enforcing them. As the author of Debt Generation, David Malone, explained in a recent talk on bilateral and multilateral trade agreements (essential viewing for anyone interested in the subject), what gives trade treaties such as TTIP and TISA their “claws and teeth” is the inclusion of an innocuous-sounding provision called the “investor-state dispute settlement.” This effectively allows private companies to sue entire nations if they feel that a law lost them money on their investment.

No Trial, No Judge, No Jury

Say, for example, a newly elected government decides — not unreasonably — that the involvement of price-gouging U.S. firms in the nation’s health service is not such a good idea after all. Each and every one of those U.S. firms will now be able to launch expensive legal battles, potentially for billions of pounds, in the name of foregone profits.

The case would not be heard in a court of law, under the scrutiny of a judge and jury, but rather in front of arbitration panels made up of three professional arbitrators — one representing the company, one representing the country and the other chosen by the first two to sit as president of the panel. None of these arbitrators are trained judges; they are private individuals often representing some of the biggest international corporate law firms, mostly from the U.S. and Europe.

The secrecy of the arbitration process is, in Malone’s words, “mind-blowing.” No citizen of any affected country can demand leverage or accountability over the proceedings. The arbitrators meet behind closed doors and do not even need to inform the people of a country that their government has been taken to arbitration.

Advocates of the system claim that international arbitration is needed because national courts are not sufficiently neutral. While there may be some truth in that, investment arbitrators themselves are hardly neutral guardians, as Corporate Europe reports:

Arbitrators, to a far greater degree than judges, have a financial and professional stake in the system. They earn handsome rewards for their services. Unlike judges, there is no flat salary, no cap on financial remuneration.

Arbitrators’ fees can range from $375 to $700 per hour depending on where the arbitration takes place. How much an arbitrator earns per case will depend on the case’s length and complexity, but for a $100 million dispute, arbitrators could earn on average up to $350,000. It can be far more. The presiding arbitrator in the case between Chevron and Texaco v. Ecuador, received $939,000…

Evidence shows that many of the arbitrators enjoy close links with the corporate world and share businesses’ viewpoint in relation to the importance of protecting investors’ profits. Given the one-sided nature of the system, where only investors can sue and only states are sued, a pro-business outlook could be interpreted as a strategic choice for an ambitious investment lawyer keen to make a lucrative living.

Revolving Doors, Conflicts of Interests

The arbitration industry, very much like our political systems, is rife with conflicts of interest and revolving doors. To wit, from the Transnational Institute:

Arbitrators tend to defend private investor rights above public interest, revealing an inherent pro-corporate bias. Several prominent arbitrators have been members of the board of major multinational corporations, including those which have filed cases against developing nations.

Law firms with specialised arbitration departments seek out every opportunity to sue countries – encouraging lawsuits against governments in crisis, most recently Greece and Libya, and promoting use of multiple investment treaties to secure the best advantages for corporations… In short, investment lawyers have become the new international ‘ambulance chasers’, in a similar way to lawyers who chase hospital wagons to the emergency room in search for legal clients.

Arbitration law firms as well as elite arbitrators have used positions of influence to actively lobby against any reforms to the international investment regime, notably in the US and the EU. Their actions, backed by corporations, succeeded in preventing changes that would enhance government’s policy space to regulate in the US investment treaties that had been proposed by US President Barack Obama when he came to office.

The rise of investor-state dispute settlements and the broad application of arbitration procedures are the ultimate victory in the global corporatocracy’s decades-long coup d’état. If allowed to take universal effect, the system will impose above you, me, and our governments a rigid framework of international corporate law designed to exclusively protect the interests of corporations, relieving them of all financial risk and social and environmental responsibility. From then on, every investment they make will effectively be backstopped by our governments (and by extension, you and me); it will be too-big-to-fail writ on an unimaginable scale.

And yet, in the most perverse of ironies, it is a system that appears to be almost universally endorsed by our political leaders. It is an irony that was not lost on the Spanish arbitrator Juan Fernandez-Armesto, who had the following to say:

When I wake up at night and think about arbitration, it never ceases to amaze me that sovereign states have agreed to investment arbitration at all […]. Three private individuals are entrusted with the power to review, without any restriction or appeal procedure, all actions of the government, all decisions of the courts, and all laws and regulations emanating from parliament.

As I warned in early November 2013, the global corporatocracy is almost fully operational. The intentions of those negotiating the multiple trade treaties are now crystal clear: to place complete power and control over our economies in the hands of the largest global corporations, many of which bear the lion’s share of responsibility for the economic and environmental mess we’re already in.

In the meantime, the clock continues to tick down. At any moment, a few quiet strokes of a pen behind the tightly closed doors of a luxury conference room could usher in a new age of corporate domination. With it will come a new kind of dystopia, bearing an uncanny likeness to the inverted totalitarianism foreseen by Sheldon Wolin.

22 June 2014

http://www.nakedcapitalism.com/